Why France?

Gaming – a major industry combining high-end artistic creativity and the best in technological innovation – has a long history in France.

Proud of its history and dedicated to becoming the leading country in this industry, France has aimed, over the years, to remain an important hub for game development. Having doubts about why setting up in France? “Join the Game” illustrates the French government’s commitment to offer foreign publishers and developers – studios and independents – opportunities to discover the optimal environment to excel.

Energy

A dynamic and ambitious economic policy

Talents

Skills in all areas of the gaming industry

Listening

A state listening to companies

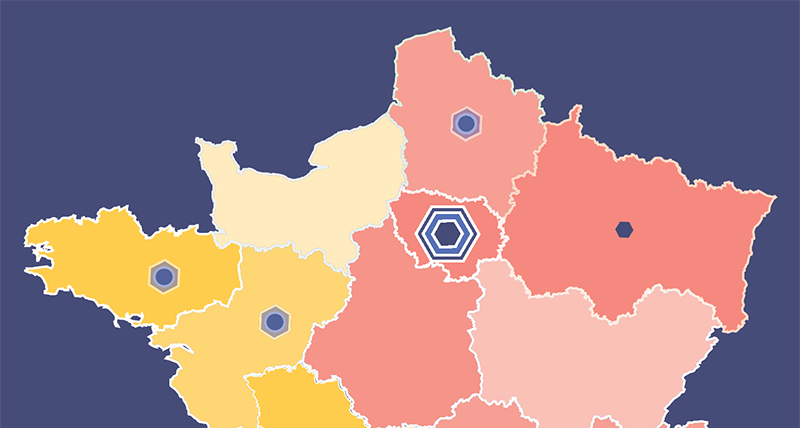

Ecosystem and talents

Ecosystem and talents

An asset for developing your business

France has a dynamic network of publishers and studios, all of which are part of a structured and active ecosystem. It is composed of regional clusters, research laboratories and high- end schools constantly training new international talent.

Video games tax credit (CIJV)

30% tax credit of eligible production expenditure

The CIJV plays an essential role in the cost competitiveness of the French market. With its grant of €53 million in 2019, it has contributed to the creation of many emblematic productions and supported more than 200 projects across 100 companies such as Ubisoft, Arkane, Don’t Nod, Cyanide, Quantic Dream, Ankama, Asobo, Spiders, Amplitude Studio, Old Skull Games...

Video Games Support Fund (FAJV) :

Video Games Support Fund (FAJV) :

The Video Games Support Fund (FAJV) supports creation in the video games industry through four selective grants designed to assist authors and creative companies in all phases of game development (writing, pre-production and production of video games) as well as promotional events.

Support for R&D and company development

Unlocking technological solutions

Calls for Projets de Recherche et Développement Structurants pour la Compétitivité-Régions (PSPC-Régions), calls for projects from the Programme d’Investissement d’Avenir (government fund dedicated to technologies of the future), calls for projects from the Réseau Recherche et Innovation en Audiovisuel et Multimédia (RIAM, fund dedicated to R&D projects in AV equipment and multimedia), financial assistance from the Banque Publique d’Investissement (public investment bank), easier access to French Tech’s services, etc.

And also…

Many other tax provisions to support businesses

R&D tax credit of 30%, innovation tax credit of 20% for SMEs, Young Innovative Company status etc.

Edited on 23/03/2023